How AI Helps Insurance Companies Automate Claims Processing

- jeslynjames

- Jul 14, 2022

- 2 min read

Automation has become an integral part of streamlining business processes, and industries across the globe are adopting automation solutions for this very purpose. Insurance companies are slowly moving towards AI solutions that can increase the efficiency of claims processing and offer end-to-end automation.

With the growing customer base and increased competition to provide quick and quality service, insurance companies can no longer afford to depend on traditional document processing tools. To thrive in today's changing world, insurance companies need to increase their business process efficiency, enhance productivity, and offer better customer relations. Here is where AI can help insurance companies rise to the challenge.

Automation in Claims Processing

Like many other industries, the insurance sector is rapidly adopting AI solutions to streamline its business process and automate claims processing. Once insurance companies embrace the opportunities offered by automation, they can drastically change their business operations.

The slow, inefficient, and error-prone traditional claims processing methods that affect insurance companies' overall efficiency and productivity can be replaced by AI-powered claims automation solutions that reduce processing time and cost and increase the quality of customer service.

With AI in claims processing, insurance companies can change the perception of claims processing as a time-consuming process by customers.

An efficient AI-powered claims processing solution can improve the trust and reliability of customers upon the insurance companies to process claims faster. Insurance companies, on the other hand, can experience business growth, better customer relations, and reduced processing time and cost.

End-to-end automation

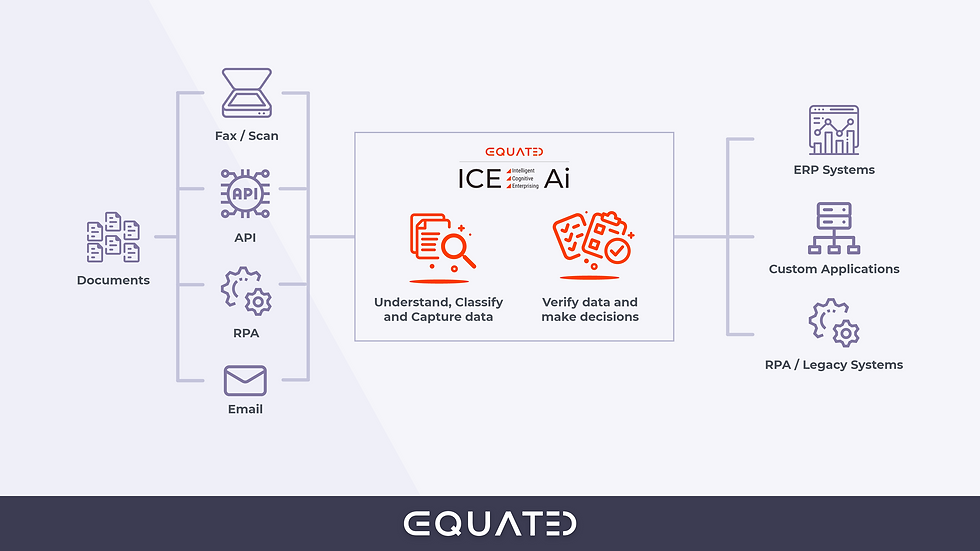

Insurance companies need a document processing solution that does much more than extracting data from different documents. From receiving the claims documents submitted by the insured to its approval, insurance companies need an automation solution that can take care of end-to-end automation without human intervention and Equatd's ICE-Ai offers to do just that.

With ICE-Ai, insurance companies can not only drive operational efficiency but achieve end-to-end automation and take a step towards digital transformation. As ICE-Ai extracts information such as patient name, policy number, amount, invoice date, and number, the extracted information is compared with different pages in the claim document, with the company's internal application, or with a third-party system.

No matter how complex documents are, ICE-Ai can process documents faster, accurately, and more efficiently so that insurance companies can achieve higher levels of straight-through processing. ICE-Ai, as a smart AI-powered intelligent document processing tool, removes bottlenecks in your document-intensive process to optimize and automate claims processing.

It is high time that insurance companies took advantage of AI-powered document processing tools to reduce operational costs, wait time, and data entry errors, improve compliance, customer experience, and faster turnaround time for claims processing.

Not all automation solutions can guarantee the desired results. Choosing the right that accommodates your business needs and provides a greater Return on Investment is important. Spend a few more minutes to learn more about how ICE-Ai is the best automation solution for you.

Comments